Get the free tc 721g

Show details

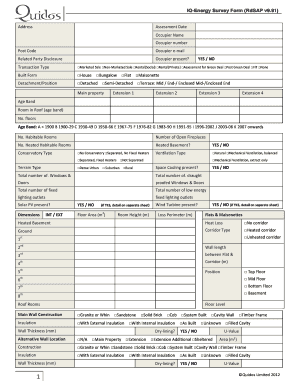

Utah State Tax Commission TC-721G Exemption Certificate for Governments Schools Rev. 6/14 Sales Use Tourism and Motor Vehicle Rental Tax Name of institution claiming exemption purchaser Telephone Number Street Address City Authorized Signature State Name please print ZIP Code Title Date Name of Seller or Supplier The person signing this certificate MUST check the applicable box showing the basis for which the exemption is being claimed. Questions...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tc 721g form

Edit your tc721g form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tc 721g utah online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit utah tc 721g form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

tc 721 form

: Try Risk Free

People Also Ask about form tc 721

How does Utah sales tax work?

Utah is an origin-based sales tax state. This means you should be charging Utah customers the sales tax rate for where your business is located. That rate could include a combination of state, county, city, and district tax rates. The state sales tax rate is 4.85%.

How do I get a tax exempt number in Utah?

How do I get a sales tax exemption number for a religious or charitable institution? Complete Form TC-160, Application for Sales Tax Exemption Number for Religious or Charitable Institutions.

How do I verify a Utah resale certificate?

Utah – There is no online way to verify a resale certificate online. Utah allows merchants to accept resale certificates “in good faith.”

How do I calculate sales tax in Utah?

How much is sales tax in Utah? The base state sales tax rate in Utah is 4.85%. Local tax rates in Utah range from 0% to 4%, making the sales tax range in Utah 4.7% to 8.7%.

How do I get a Utah resale certificate?

To get a resale certificate in Utah, you will need to fill out the Utah Exemption Certificate (Form TC-721), the Streamlined Sales Tax Agreement Certificate of Exemption, or the Uniform Sales & Use Tax Certificate Form.

How much sales tax do I charge in Utah?

Utah sales tax details The Utah (UT) state sales tax rate is 4.7%. Depending on local jurisdictions, the total tax rate can be as high as 8.7%. Local-level tax rates may include a local option (up to 1% allowed by law), mass transit, rural hospital, arts and zoo, highway, county option (up to .

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in utah tax exempt form tc 721g without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing 721g and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How can I edit utah tc 721 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing tc721, you need to install and log in to the app.

How do I edit tc 721 utah on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign utah tc 721 form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is tc 721g?

TC 721G is a tax form used for reporting certain types of income or deductions to the IRS, particularly related to specific transactions or income adjustments.

Who is required to file tc 721g?

Individuals or entities that have engaged in the transactions or income categories covered by TC 721G are required to file this form.

How to fill out tc 721g?

To fill out TC 721G, follow the instructions provided in the form guidelines, ensuring to include all required information such as personal identification details, income or deduction amounts, and any relevant transaction descriptions.

What is the purpose of tc 721g?

The purpose of TC 721G is to provide the IRS with a detailed account of specific financial transactions, which helps in accurate tax assessment and compliance.

What information must be reported on tc 721g?

Information that must be reported on TC 721G includes taxpayer identification information, details of the transactions, amounts of income or deductions, and any pertinent supporting information related to the transactions.

Fill out your tc 721g form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Utah Sales Tax Rate is not the form you're looking for?Search for another form here.

Keywords relevant to teach grant certification form

Related to utah resale certificate

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.