Please notify the Tax Commission of any changes to the information provided. No refund is given if the exemption certificate submitted with this form is determined to be fraudulent.

Get the free tc 721g form

Show details

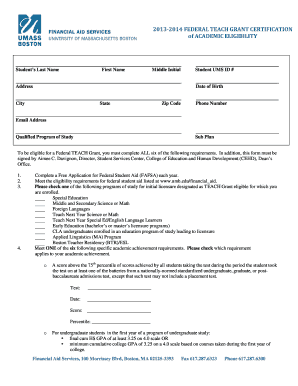

Utah State Tax Commission TC-721G Exemption Certificate for Governments Schools Rev. 6/14 Sales Use Tourism and Motor Vehicle Rental Tax Name of institution claiming exemption purchaser Telephone Number Street Address City Authorized Signature State Name please print ZIP Code Title Date Name of Seller or Supplier The person signing this certificate MUST check the applicable box showing the basis for which the exemption is being claimed. Questions...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your tc 721g form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tc 721g form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tc 721g online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tc721g form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Fill form : Try Risk Free

People Also Ask about tc 721g

How does Utah sales tax work?

How do I get a tax exempt number in Utah?

How do I verify a Utah resale certificate?

How do I calculate sales tax in Utah?

How do I get a Utah resale certificate?

How much sales tax do I charge in Utah?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file tc 721g?

The IRS form TC 721G is not a form that is required for filing by taxpayers.

How to fill out tc 721g?

To fill out IRS Form TC-721G, follow these steps:

1. Start by entering the year for which you are filing the form in the top right-hand corner.

2. In the first column, provide your personal information, including your full name, mailing address, and social security number.

3. In the next column, state your percentage of ownership of the property if it is jointly owned. If you are the sole owner, leave this section blank.

4. Provide the same personal information for your spouse or co-owner of the property in the subsequent columns.

5. In the next section, you will describe the property that you own. Provide the tax parcel number, legal description, and physical address of the property.

6. If you are applying for a property tax exemption or abatement, select the appropriate box indicating the exemption type.

7. In the last section, sign and date the form.

Make sure to review the form for accuracy before submitting it to the relevant tax authority.

What is the purpose of tc 721g?

TC 721G refers to a specific technical circular issued by the International Civil Aviation Organization (ICAO). However, as of my database, there is no specific information available regarding TC 721G. It is possible that the designation may be associated with a different regulatory or technical document, or it could be an incorrect reference. Please provide more context or check for accuracy to get further assistance.

What information must be reported on tc 721g?

TC 721G refers to a tax form used to report the sale, transfer, or exchange of real property by a nonresident individual or entity in California. The information that must be reported on TC 721G includes:

1. Seller Information:

- Name, address, and taxpayer identification number (TIN) of the seller(s)

- Legal status of the seller (individual, trust, partnership, corporation, etc.)

2. Buyer Information:

- Name, address, and TIN of the buyer(s)

3. Property Information:

- Description of the property being transferred, including legal description and address

- Date of transfer

4. Gross Sales Price:

- The total consideration given for the property, including any cash, promissory notes, debt relief, or other forms of payment

5. Allocation:

- Breakdown of the sales price into land, improvements, personal property, etc.

6. Withholding Information (if applicable):

- If the buyer is required to withhold California income tax on the sale, the amount withheld should be reported.

7. Seller's Principal Residence Exclusion (if applicable):

- Whether the property is the seller's principal residence and eligible for an exclusion under California law.

It is important to note that specific requirements and guidelines may vary depending on the circumstances and regulations in California. It is recommended to consult the official instructions and guidelines provided by the California Franchise Tax Board or seek professional advice when completing TC 721G.

What is the penalty for the late filing of tc 721g?

The penalty for the late filing of TC 721G can vary depending on the jurisdiction and specific circumstances. In general, late filing penalties may include a fixed penalty amount, daily or monthly penalties, or a percentage-based penalty calculated on the tax due. It is best to consult with a tax professional or refer to the relevant tax authority's guidelines for the specific penalty that may apply in your situation.

How do I make edits in tc 721g without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing tc721g form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How can I edit utah state tax exempt form tc 721g on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing tc 721g fillable, you need to install and log in to the app.

How do I edit tc 721g form on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign utah tax exempt form tc 721g. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your tc 721g form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Utah State Tax Exempt Form Tc 721g is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.